Blog Series: Your Checklist For Filing Your Taxes After Divorce

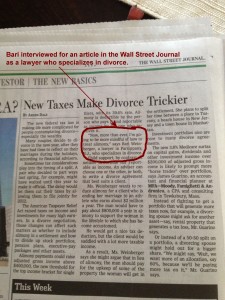

Ending a marriage is difficult enough. But if you’re recently separated or divorced, you have the added burden of figuring out a new and potentially more complicated tax situation. How will your divorce affect how you file your income taxes…and what’s the impact on what you will owe or receive back from the IRS? Our 3-part series, “Filing Your Taxes After Divorce,” delivers the answers you need to understand and feel more confident about possible tax changes coming your way. Read more